Primonial REIM France et Société Générale Assurances annoncent l'acquisition de l'ensemble immobilier de bureaux "Window" à la Défense (92) auprès d'Oxford Properties Group

Primonial REIM France alongside its partner Société Générale Assurances has finalised the acquisition of the “Window” office property complex located in La Défense (92).

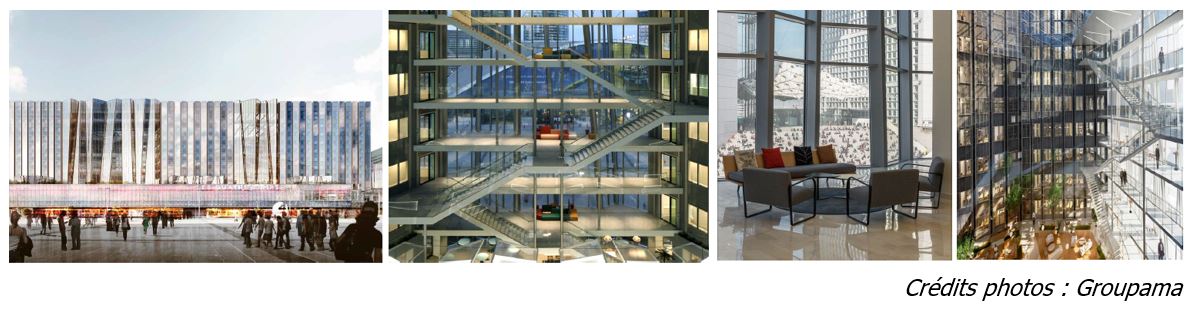

The “Window’ building comprises close to 45,000 m2 of office space classified under the French Labour Code and was fully renovated in 2018.

It hosts RTE (Réseau de Transport d’Electricité, France’s transmission system operator) as the sole tenant under a fixed 12-year lease.

EXCEPTIONAL VISIBILITY FOR A BUILDING OF THE HIGHEST INTERNATIONAL STANDARDS

“Window” enjoys excellent visibility thanks to a linear 150-metre façade overlooking one of Europe’s busiest shopping centres, the “Westfield Les 4 Temps” in La Défense, Europe’s leading business district.

The property has obtained the HQE Excellent and BREEAM Excellent environmental certifications. It offers its occupants a range of top-quality amenities and services: office floor space 4,500 m2 deep and receiving direct light, designed for flexible use, and offering a splendid panoramic view on the 7th storey thanks to full-length windows; staff restaurants and cafeterias; a brasserie; a conference centre; a business lounge; a fitness centre; a concierge service; and two vast atriums.

Grégory Frapet, Chairman of Primonial REIM France: "We are delighted with this new major real estate transaction completed alongside Société Générale Assurances. The acquisition of the “Window” building is among the largest transactions in volume terms to have taken place in the office property market so far this year and yet another example of our capacity to take up positions on large-scale operations on behalf of our investor-clients. The transaction is also testament to our strong convictions about the office property market and to our investment strategy, which is geared towards building up positions in sizeable head offices located in the heart of the Greater Paris region and occupied by large corporate tenants."

Yann Briand, Head of Real Estate at Société Générale Assurances: "The acquisition of the “Window” building is fully consistent with the strategy adopted by Société Générale Assurances in our capacity as a responsible investor geared towards investing in highly energy-efficient real estate. The asset’s intrinsic qualities will secure reversibility and resilience for the property over the long term. We are delighted to have partnered up with Primonial REIM France and worked together on adding value to this property."

Pierre Leocadio, Head of Investments Europe at Oxford Properties: "We are delighted to have worked with the teams at Primonial REIM France and Société Générale Assurances who approached us off-market. The sale of “Window” sends out a strong signal about the La Défense market and we intend to reinvest the proceeds from this sale in new transactions targeting new sectors with a view to diversifying our portfolio, which we would like to double in size within the next 5 years."

Primonial REIM France and Société Générale Assurances were advised for the purposes of this transaction by the Clifford Chance law firm (legal aspects), the Cheuvreux consultancy (notarial aspects), ARC (technical aspects), Mazars (accounting) and KPMG (taxation).

The transaction was carried out together with BNP Paribas Real Estate.

Oxford Properties was advised for the purposes of this transaction by the Lacourte Raquin Tatar law firm (legal aspects), the Lasaygues consultancy (notarial aspects), the Bredin Prat consultancy (taxation) and Denjean (accounting).

About Primonial REIM

Primonial REIM brings together more than 400 employees in France, Germany, Luxembourg and Italy and applies its core values of conviction and commitment, as well as its expertise on a European scale, to design and manage real estate funds for its national and international clients, whether individual or institutional.

Primonial REIM has €30 billion in assets under management. Its allocation breaks down into: 50% offices, 32% health / education, 10% commerce, 6% residential, 2% hotels. The pan-European platform manages 61 funds and brings together more than 80,000 investor clients, of which 54% are individuals and 46% institutional. Its real estate portfolio is made up of more than 1,400 buildings (offices, health / education, retail, residential, hotels) located in nine European countries.

About Société Générale Assurances

Société Générale Assurances is at the heart of Société Générale Group’s development strategy, in synergy with all its retail banking, private banking and financial services businesses in France and abroad. Société Générale Assurances also pursues the expansion of its distribution model through the development of external partnership agreements.

Present in France with Sogécap, Antarius, Sogessur and Oradéa Vie, and in 9 countries abroad, Société Générale Assurances offers a full range of products and services to meet the needs of individual, professional and corporate clients in life insurance savings, retirement savings, and personal and property insurance.

Thanks to the expertise of its 3,000 employees, Société Générale Assurances generated 11.3 billion euros of revenue in 2020 and manages 126 billion euros of assets and 23 million policies.

About Oxford Properties Group

Founded in 1960, Oxford Properties owns, develops and manages a portfolio of property assets worldwide valued at over 60 billion Canadian dollars. Oxford is based in Toronto and operates over 15 regional offices in North America, Asia-Pacific and Europe.

Oxford Properties is owned by OMERS (rated AAA by DBRS and AA+ by Standard & Poor’s), one of Canada’s largest pension plans managing an asset portfolio worth over 115 billion Canadian dollars.

Since 2014, Oxford has built up a property portfolio in Paris valued at over two billion Canadian dollars.

et Firefox

et Firefox