Our climate strategy

Real estate and construction account for 38% of global greenhouse gas emissions. As a real estate asset management company, Praemia REIM France has a role to play in the fight against global warming.

We are committed to continuously improving the environmental performance of our European real estate assets with the main objective of achieving carbon neutrality by 2050 in accordance with the Paris Agreements.

Our assets, valued at €38 billion in assets under management and spread over 10 different countries, imply a very broad coverage of Praemia REIM's Environmental, Social and Governance (ESG) strategy.

OUR ACTION PLAN

By 2030

Steering objectives for all of Praemia REIM's real estate assets based on a best-in-progress principle of -5% carbon emissions per year, in line with the Net Zero Carbon trajectory set for 2050.

By 2050

Aligning real estate assets with a fixed Net Zero Carbon trajectory.

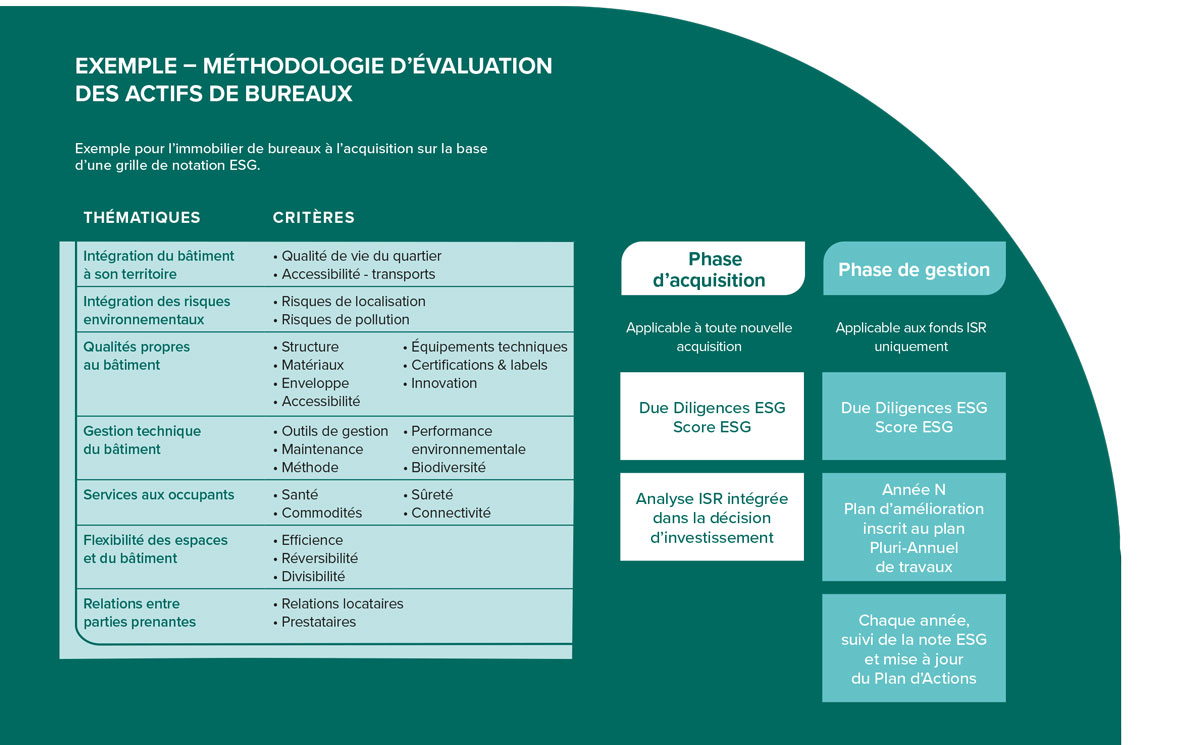

1. Extra-financial rating of real estate assets

To support our responsible investor approach, we have established multi-criteria ESG rating grids divided into 7 themes, applicable to all our asset classes: Offices, Health/Education, Retail, Residential and Hotels.

These tools allow us to evaluate any new real estate acquisition on the basis of extra-financial information.

Throughout the management phase, we implement a continuous improvement approach to optimize energy consumption and reduce the carbon impact of our real estate.

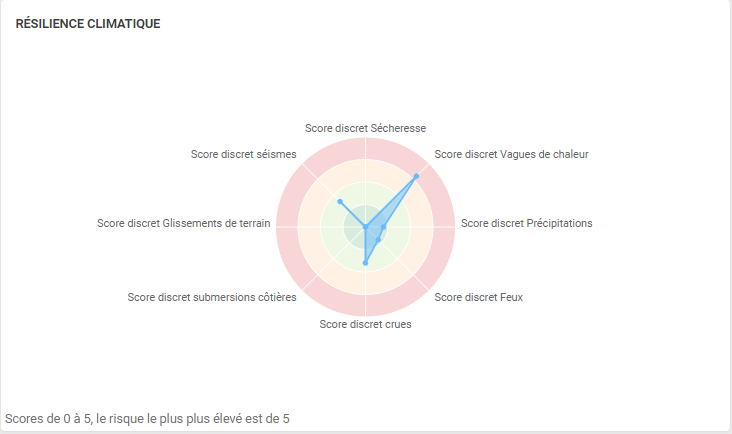

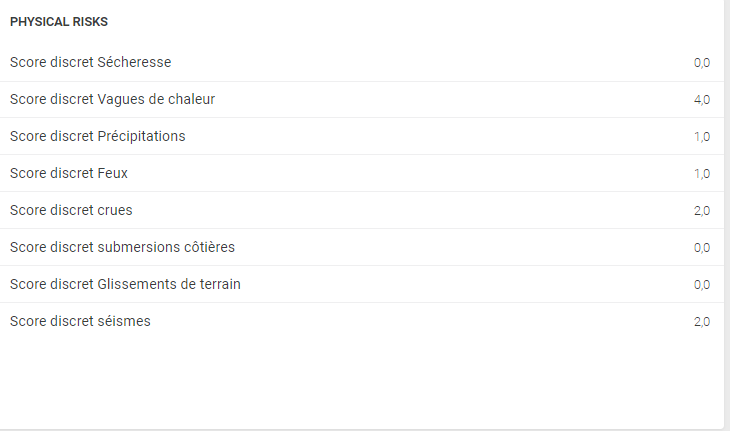

2. Sustainability Risk Mapping

The sustainability risk map analyzes the exposure of Praemia REIM France's assets to the main climate risks:

- identify the most exposed assets to define a specific action plan.

- revise the list of arbitrations for assets exposed to a proven risk that is difficult to adapt.

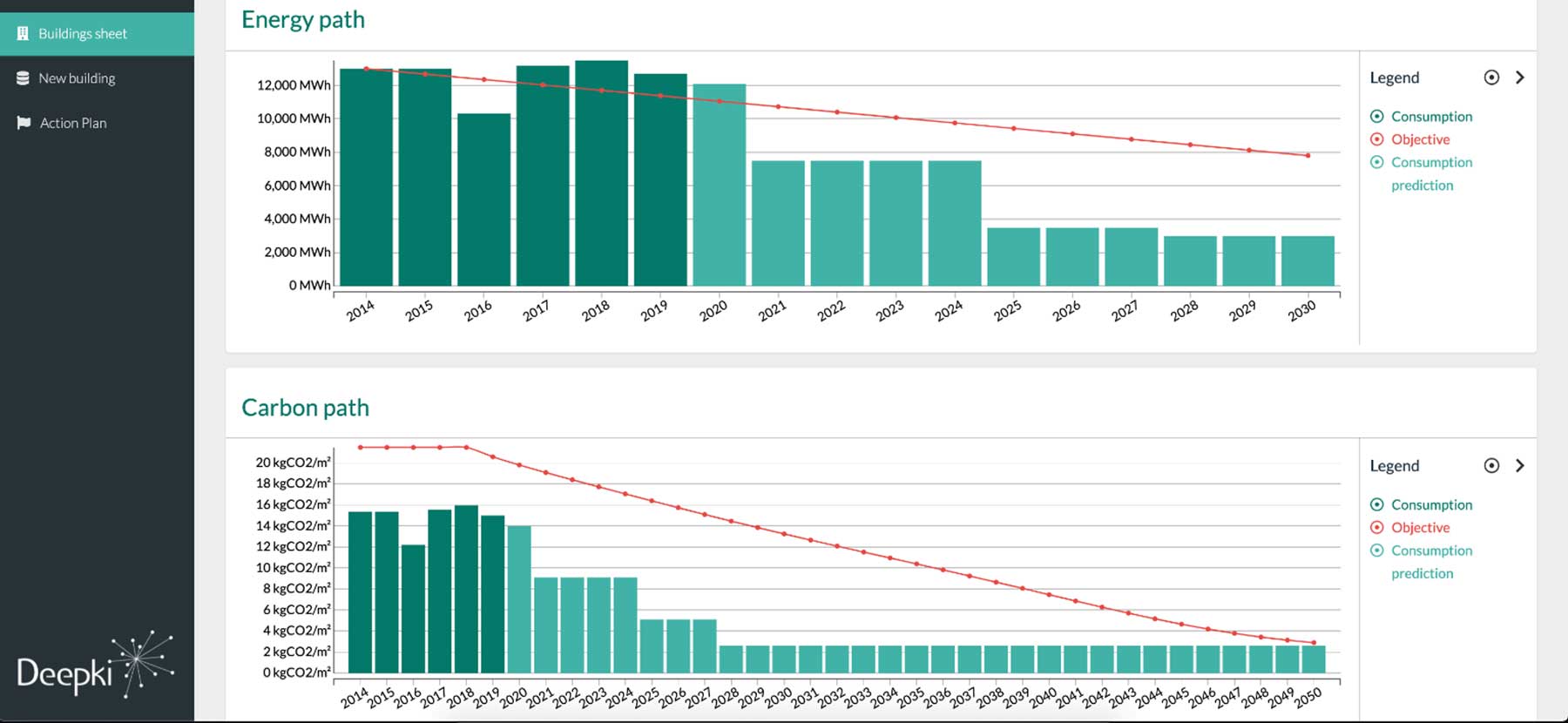

3. Monitoring of the carbon trajectory

For the decarbonization of our building stock, we collect data via the Deepki platform to ensure scientific reliability of the data and an independent approach.

Our objective is to align the estimated future consumption of our real estate assets with the CRREM 1.5 C° trajectory, based on action plans that are reviewed annually (expected carbon savings, Capex budget to be invested/already invested).

Case study - projection

Praemia REIM France supports its office building tenants in the energy transition with the Eco-énergie tertiaire scheme.

This scheme aims to reduce energy consumption jointly between tenants and owners. It applies to tertiary buildings of more than 1,000m2 with targets for 2030, 2040 and 2050. Praemia REIM France is therefore committed to bringing its real estate assets into compliance with the Eco-Energy Tertiary scheme.

4. Process responsible for restructuring

For properties under development or undergoing restructuring managed by Praemia REIM France, we perform a carbon assessment over the entire real estate life cycle to minimize CO2 emissions.

As a long-term investor, we are committed to applying the principles of "Best in Progress" by concentrating our investment efforts on improving our existing real estate portfolio, thereby helping to combat the artificialization of land and urban sprawl.

5. Costed action plan for divestitures

For sold buildings, we systematically communicate to the buyer the quantified action plans necessary to reach the Net Zero Carbon objective.

et Firefox

et Firefox