- Home

- Investment solutions

- Life insurance

- SCI Cap Santé

SCI Cap Santé

Cap Santé, health real estate in your life insurance

SCI Cap Santé is a non-trading property company whose objective is to build up, manage and develop a portfolio of unlisted healthcare property located in Europe. As a unit of account within your life insurance policy, SCI Cap Santé offers the attractive performance of European healthcare property.

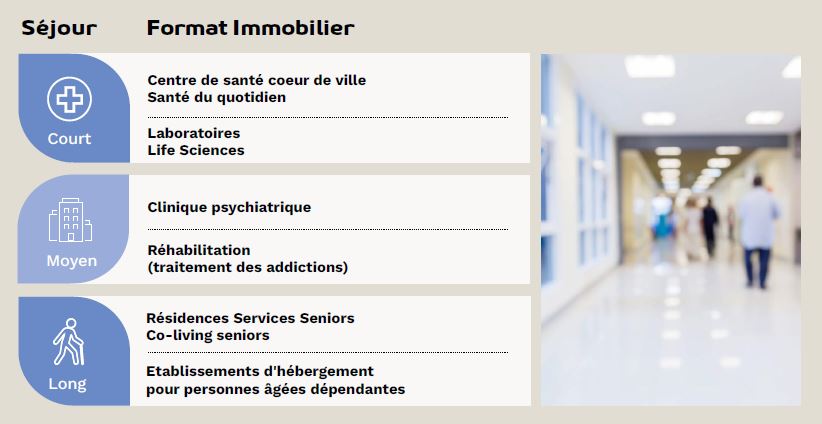

SCI Cap Santé invests in all types of healthcare property in Europe.

Investing in all forms of healthcare property to meet the needs of Europe's population:

The Praemia REIM France teams integrate ESG criteria into the acquisition and management process, using an exclusive approach developed by the management company. They accurately measure the impact of their investments by monitoring key indicators.

YouTube will only allow users to watch its videos if they accept the installing of trackers so that they can be shown targeted advertising according to their browsing history. You have rejected marketing cookies, including from YouTube. If you accept marketing cookies, trackers will be installed and you will be able to watch the video. You may withdraw your consent at any time by visiting our personal data and cookie policy page.

Change my consent preferencesWhy invest in SCI Cap Santé?

Praemia REIM France, a pioneer and leader in healthcare property in Europe for over 10 years

More than 10 billion euros under management

More than 40 employees, experts in healthcare real estate in Europe, covering all aspects of the real estate value chain (investment, asset management, property management)

A fund benefiting from a contribution of more than €100 million of healthcare real estate assets managed by another Praemia REIM France fund at creation

Cap Santé already has a portfolio of €100 million in real estate assets, consisting of 100 million in real estate assets, consisting of French healthcare establishments such as clinics, laboratories, medical and surgical facilities obstetrics

An annual performance objective of over 5%.

*The healthcare real estate sector is an acyclical sector, driven by favourable long-term demographic trends

*The European market is dominated by players with whom Praemia REIM has forged virtuous relationships, enabling Cap Santé to carry out exclusive transactions in addition to its selection of funds

*This dedicated positioning allows Cap Santé to target an average annual performance of over 5%. Performance is not guaranteed.

Responsible investments, classified under article 8 SFDR of the European Disclosure Regulation

Cap Santé promotes environmental and social criteria in its investment policy.

Cap Santé key figures

Conditions of subscription to 22/04/2025

Annual results (%)

2024

2023

2022

-5,88%

6,56

6,60

Results excluding fees. Previous investments are not a reliable indicator of future results.

Where to find Cap Santé ?

SCI Cap Santé is available in the form of Units of Account in a life insurance contract. Contact your wealth management advisor.

What are the potential risks?

INCOME RISK AND RISK OF CAPITAL LOSS

The potential income from healthcare real estate may go up or down, as well as the value of the assets. The Company does not offer any guarantee of capital protection. Investors are warned that their capital is not guaranteed and may not be returned or may only be partially returned. Investors should not invest in the Company if they are not able to bear the consequences of such a loss. Exposure to these risks may result in a decrease in the Company's NAV.

MARKET RISK

The investments made by the SCI will be subject to the risks inherent in the holding and management of Real Estate Assets. In this context, the performance and the evolution of the invested capital are exposed to the risks linked to the evolution of this asset class. A large number of factors (generally related to the economy or more specifically to the real estate market) may cause the value of the Real Estate Assets held by the SCI to fall. No assurance can therefore be given as to the performance of the Real Estate Assets held by the SCI.

LIQUIDITY RISK

The Company is unlisted and has less liquidity than financial assets. Liquidity is restricted under certain conditions related to the real estate market and the market for shares. A partner's request for withdrawal, over a short period of time, may have an unfavorable impact on the sale price of the buildings or holdings, which will have to be sold within a limited period of time, which could have an unfavorable impact on the Company's value. The risk class does not take into account early redemptions or arbitrages or purchases on credit that associates may have to make. Associates are warned that early redemption may result in additional losses and costs. Because this product does not provide market protection or a capital guarantee, an associate may lose all or part of his or her investment or may have to sell at a price that will significantly affect the amount he or she receives in return. Any decision to withdraw by an associate is exercised under the conditions defined by law and the articles of association.

RISK RELATED TO INDEBTEDNESS

The Company will use debt to finance some of its investments. Under these conditions, fluctuations in the real estate market may significantly reduce the Company's ability to repay its debt and fluctuations in the credit market may reduce its sources of financing and significantly increase the cost of such financing. The effect of leverage is to increase the Company's investment capacity, but also the risk of loss.

SUSTAINABILITY RISK

A sustainability risk is an environmental, social, or governance event or condition that, if it occurs, could have a material adverse effect, actual or potential, on the performance of the investment. Damage due to the realization of sustainability risks may result in repair costs or physical inability to occupy the premises, which would result in a loss of rent. Such damage may deteriorate the value of the asset or make its disposal more difficult or impossible.

Register for our newsletter

Please complete the form below.

Download a study

Please complete the form below.

Register for our research newsletter

Please complete the form below.

Information

Pour votre confort de navigation, nous vous invitons à

utiliser les navigateurs Chrome  et Firefox

et Firefox