A SUSTAINABLE PLANET

Reducing the environmental impact of our assets

our

commit

ment

in favor of the climate

for a sustainable planet

Buildings are among the largest culprits for CO2 emissions.

One of the biggest challenges of our time will be fighting climate change and saving our planet.

The need to de-carbonise real estate, starting with all existing assets, means that we must implement environmental indicators and positive actions.

IN FRANCE, THE REAL ESTATE SECTOR ALONE ACCOUNTS FOR

30%

OF ALL GREENHOUSE GAS EMISSIONS

Saving our environment has become an unavoidable issue. And our collective consciousness has been recently further reminded of this by the Covid-19 pandemic.

More than just blindly applying new and more ambitious regulations, we are more than ever being subjected to a profound need to change the mould and a find a new direction.

Beyond simply informing our clients more effectively, the introduction of extra-financial criteria into our investment and management methods are an opportunity to make real-estate Asset Management into a much more complete and exciting function for those involved.

our

action

on the real-estate

value chain

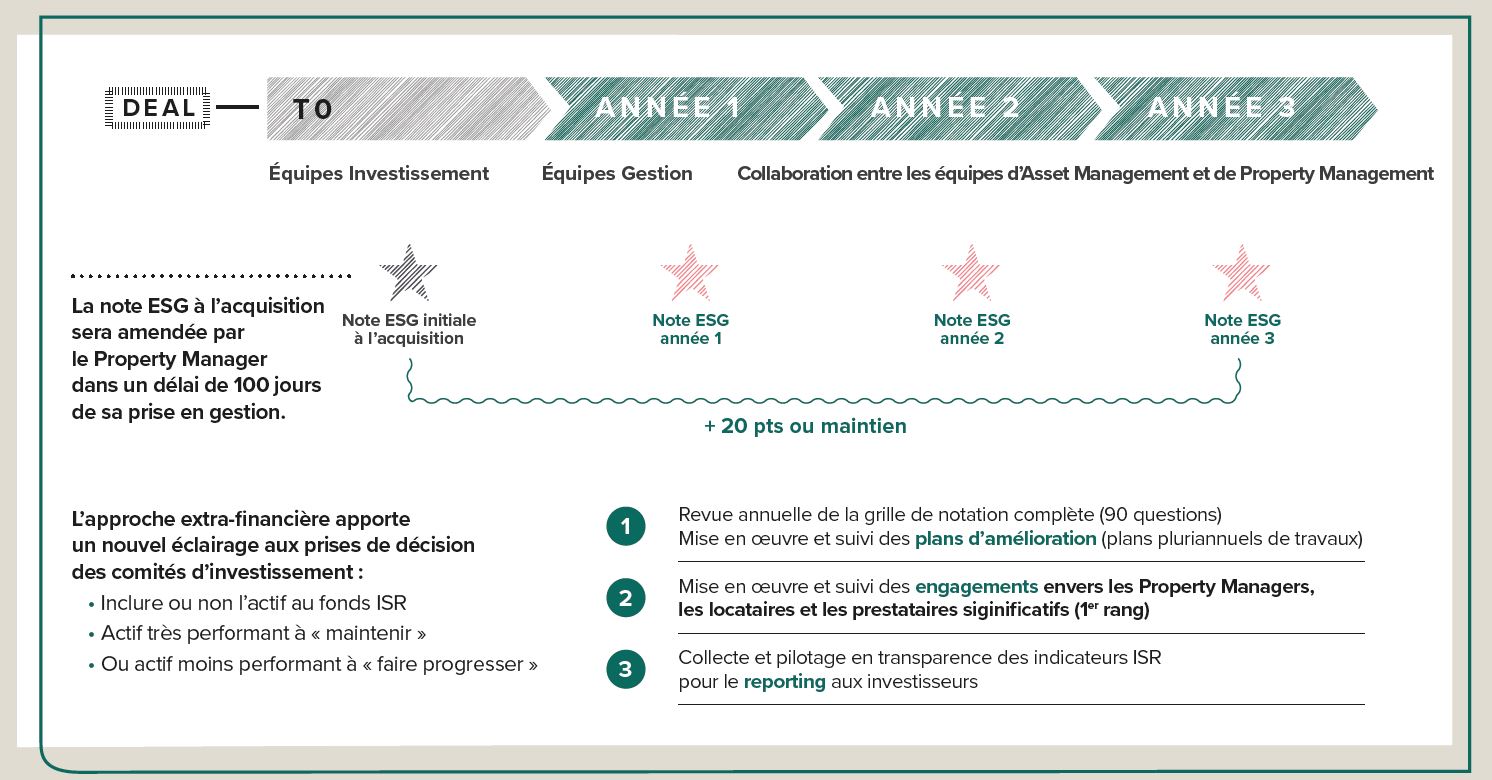

The need to de-carbonise real estate, mainly the existing assets, means that we must implement environmental indicators and positive actions over the whole of the real-estate value chain.

Due Diligences

ESG

ESG Score

SRI analysis

integrated into the

investment decision

Year N

Improvement plan incorporated

into the Pluri-Annual

works plan

Every year

ESG score

monitoring

Annual update of

the action plan

acquis

ition

We focus in advance

on investing in efficient assets,

with high environmental performances.

To support our responsible investor approach, we have established a multi-criteria ESG scoring table divided into 7 themes and which can be used for office buildings or any other asset classification (health/education, retail, residential, hotels).

These tools allow us to evaluate each new real-estate acquisition based of extra-financial information.

100% of our real-estate investments are subjected to ESG due diligence which results in a score being attributed to the asset.

ESG scoring example for office buildings. Evaluation of assets based on a scoring table made up of 90 questions covering 7 major themes and 22 sub-themes.

HOW THE BUILDING IS INTEGRATED INTO ITS SURROUNDINGS

- Quality of life for the local district

- Transport access

INTEGRATION OF ENVIRONMENTAL RISKS

- Location-associated risks

- Risks of pollution

SPECIFIC BUILDING

QUALITIES

- Structure

- Materials

- Shell

- Accessibility

- Technical facilities

- Certifications and labels

- Innovation

TECHNICAL BUILDING MANAGEMENT TOOLS

- Management tools

- Maintenance

- Method

- Environmental performance

- Biodiversity

OCCUPIER SERVICES

- Healthcare

- Commodities

- Security

- Connectivity

BUILDING SPACE

FLEXIBILITY

- Efficiency

- Reversibility

- Divisibility

RELATIONS BETWEEN

INVOLVED PARTIES

- Leaseholder relations

- Service Providers

New time neuilly sur Seine

Galeo, Issy-Les-Moulineaux

manage

ment

ion

Throughout the management phase of our office building assets, we implement a continuous improvement approach to optimise energy consumption and reduce the carbon footprint.

At Praemia REIM France, we did not wait for the Office Building Decree (Décret Tertiaire) to come into force before collecting the necessary energy consumption data for our assets.

For example, an Energy Management action applied to our office buildings ensures the constant monitoring of the buildings’ energy consumption to reduce their environmental impact.

Thanks to our pro-active approach, we have been able to establish a detailed survey of our building stock, to focus on specific improvement levers for each situation and establish pertinent action plans :

- Optimising the building’s facilities management

- Preventative maintenance

- Investment works

Certified buildings

For our Primopierre SCPI (REIT - Real Estate Investment Trust), more than two thirds of our office buildings are certified to the market’s highest possible standards.

ESG management process validated by the special committee

restruc

turing

restructuration

Our asset restructuring

plans are an opportunity

for us to

reconfirm our standards in

terms of services and environmental performance.

We currently apply our Responsible Work-site Charter which informs our partners of what we expect from them in terms of the management of waste materials, material performances, the avoidance of work-site nuisances, respect for employment rights and the conservation of biodiversity.

As a long-term investor, we are keen to apply “Best in Progress” principles by focusing our investment efforts on progressing our existing buildings stocks and thus contributing to the fight against the artificialisation of land and urban spread.

179 CDG Neuilly-sur-Seine - Global restructuring:

7,500 m2 of offices and service for rent

Delivery: Second half of 2020

179-cdg.fr

The assets that we sell will integrate an extra-financial score responding to these ESG criteria.

We will be able to guarantee improved liquidity for any assets that we wish to sell by highlighting the extra-financial management and evaluations that have been implemented.

100%

OF OUR INVESTMENTS

HAVE BEEN SCORED FOR ESG

+ 2/3

MORE THAN TWO THIRDS OF THE OFFICE BUILDINGS MANAGED BY OUR PRIMOPIERRE SCPI ARE CERTIFIED TO THE MARKET’S HIGHEST STANDARDS

Sways - Issy-les-Moulineaux

In 2018/2019, Praemia REIM France and its partner Bouygues Immobilier restructured the Sways building: with a surface area of 40,000 m2 offering a very high standing and a wide range of services (gastronomic hall, gymnasium, ground floor retail outlets, etc.) for both the residents of the building and the surrounding quarter.

Environmental certifications: Energy positive & E2/C1 level carbon footprint reduction, “Exceptional passport” sustainable building HQE, Excellent standard BREEAM International, R2S level 3* label, Platinum Wired Score.

Sways - Issy-les-Moulineaux

In 2018/2019, Praemia REIM France and its partner Bouygues Immobilier restructured the Sways building: with a surface area of 40,000 m2 offering a very high standing and a wide range of services (gastronomic hall, gymnasium, ground floor retail outlets, etc.) for both the residents of the building and the surrounding quarter.

Environmental certifications: Energy positive & E2/C1 level carbon footprint reduction, “Exceptional passport” sustainable building HQE, Excellent standard BREEAM International, R2S level 3* label, Platinum Wired Score.

Our Primopierre SCPI,

a portfolio including a majority of office buildings

The Primopierre SCPI was founded in 2008 is considered as a reference of the business property market with a capitalisation of over 3 billion euros. On behalf of its clients it has invested with a focus on potential returns, building up a common real-estate portfolio. The Primopierre SCPI is currently applying for an SRI label for its property funds as soon as this becomes available.

et Firefox

et Firefox