- Home

- Studies and research

- Office Real Estate Study 2019

Offices in Ile-de-France

The office real estate sector is profoundly changing.

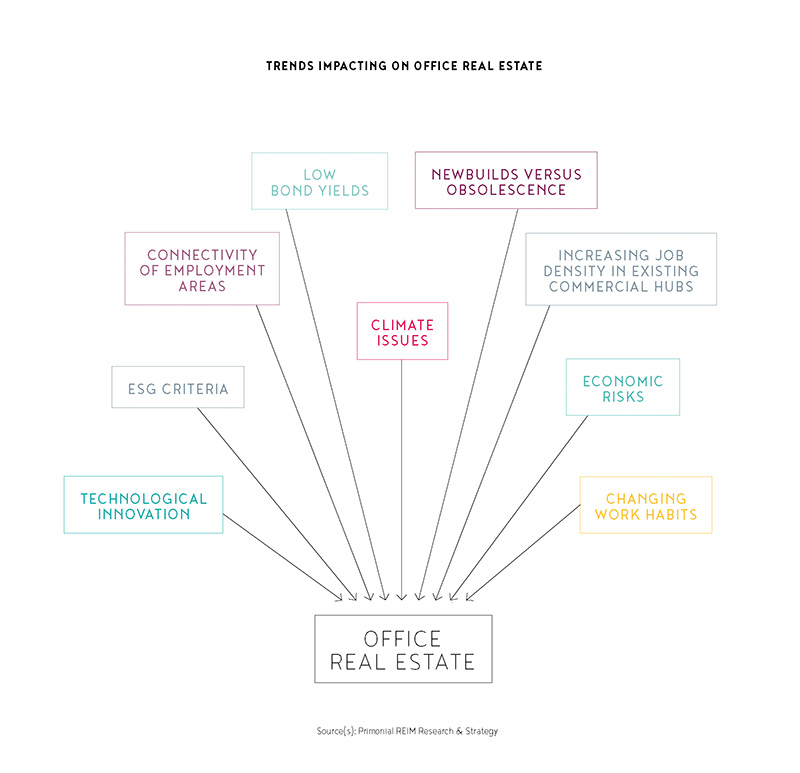

It must address the major issues with which it is directly faced: insertion of the “smart city”, driverless cars, technological innovations, changing working methods, rise in management policies integrating ESG (Environmental, Social and Governance) criteria. In our new study on office real estate, we review the evolution of this asset class and give you the Praemia REIM investment strategy.

Office property: the dawn of a new cycle

The reorganisation of the office property market, with the attractive assets on one side and the obsolete assets on the other, continues under the influence of the responses provided for these new issues. The increasing concentration of jobs and the interconnection of employment hubs will be determining factors in making commercial markets attractive. According to an ORIE (Regional Commercial Property Observatory) report the forces at work now seem to be a clear sign that the existing commercial hubs can be expected to continue to become concentrated. Accessibility will therefore contribute to the reorganisation of sectors regardless of whether the hubs are located in Central Business Districts (QCA) or peripheral zones.

Over the last ten years, property investors have for the most part opted for Core or Core+ assets that offer stable returns. The accommodating monetary policies of central banks have fed this trend by encouraging asset values to rise.

This sovereign spread lowering cycle seems to be reaching an end and we are currently moving into a low interest rate environment. This situation will have an influence on office property since a threshold seems to have been reached for “prime” property assets.

The economic and financial context seems to indicate that we are entering a property cycle transition period pushed by capital growth into a value creation oriented cycle.

This is a case of the “value investing1” approach being applied to property. It will need to lead property investors to identify the new markets where prices remain affordable and/or where there may be the benefit of a positive rental market development to create value.

Praemia REIM’s office property convictions

At Praemia REIM we feel that the location, dynamic and increasing concentration of employment hubs in relation to the improvement of transport network interconnectivity, as well as the low interest rate context are all clear signs of a cycle which will push for an adjustment in investment strategies. In this survey we took a close look at office property in the Euro Zone and the regions around Paris in particular. After analysing the investment and rental markets, we used a regional approach to overlay public transport perspectives (Grand Paris Express) and employment hubs in order to produce evaluation and selection tools for the region’s commercial markets.

1 This investment strategy was first mentioned by Benjamin Graham in ‘Security Analysis’. The strategy involves acquiring a financial asset at a price significantly below its value, producing relatively attractive long-term returns in terms of the risk involved.

Discover Primopierre

The reference SCPI in office real estate

The team

Henry-Aurélien Natter joined Praemia REIM as Research Manager in January 2018. He has the mission of developing the analyses of the Research & Strategy Department on the real estate markets, the economy and capital in France and in Europe.

Henry-Aurélien Natter began his career at Les Echos Etudes (formerly Eurostaf), then at C&W (formerly DTZ), and lastly at BNP PRE, where he acquired solid and varied experience in real estate research, strategy and finance. He is qualified with an AES degree in Business Management, a Masters Decree in management and SME management, and an International Master in commerce and marketing.

You may also like

- Market review

Real Estate Convictions : Q3 2024

In October 2024, the ECB announced its third consecutive rate cut to ease its restrictive monetary policy, and we believe that a new momentum has opened up for the European real estate market. Indeed, this quarter we have seen a thaw in certain real estate indicators.

- Market review

Real Estate Convictions : Q4 2024

The continued reduction in ECB interest rates, the level of savings amongst Europeans and the recovery of the real estate markets between 2022 and 2024 all point to the potential for improvement and a rebound in the sector.

- Thematic study

Convictions Immobilières - 1 Trimestre 2025

Alors que l’économie mondiale semblait avoir retrouvé une certaine stabilité, les incertitudes se sont renforcées lorsque l’administration américaine a fait le choix d’augmenter les droits de douane vis-à-vis du reste du monde, conduisant les marchés boursiers en zone de turbulences. Des négociations sont en cours pour trouver des solutions.

et Firefox

et Firefox